The Greek startup ecosystem is decisively moving past its emerging phase, entering 2026 with unprecedented dynamism, maturity, and international visibility. Fuelled by record investment, a strengthening venture capital (VC) environment, and a proactive suite of government policies, Greece is solidifying its claim as a leading regional tech hub.

Country Insights: Greece on the Global Innovation Ascent

Greece’s economic and political stability, recognized by The Economist as “Country of the Year” in 2023, is translating into tangible results in innovation.

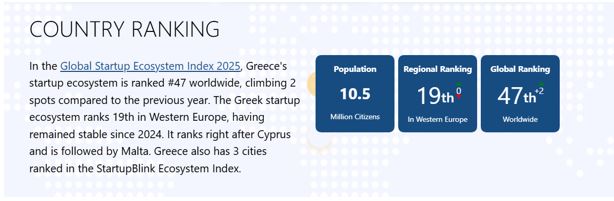

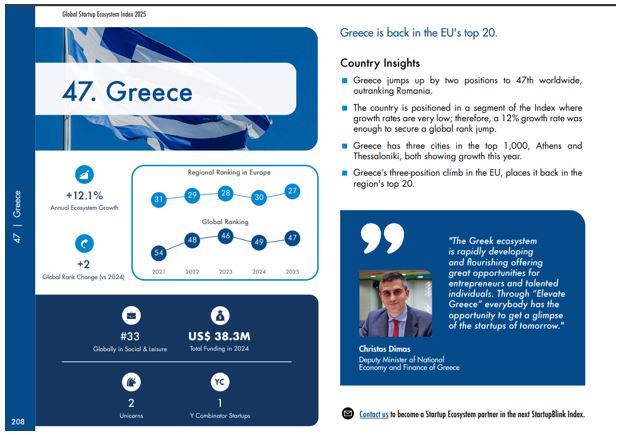

- Global Standing: Greece has significantly improved its position, jumping two spots to 47th worldwide in the Global Startup Ecosystem Index and climbing back into the EU’s top 20 in the regional rankings.

- Accelerated Growth: This ascent was driven by a robust 12% growth rate in its ecosystem value, far outpacing the generally low growth seen in many established segments.

- Economic Context: The European Commission forecasts the Greek economy to grow at a strong 2.2% in 2026, driven by investments and EU funding, providing a stable foundation for corporate expansion.

- The Startup Ecosystem: Achieving Scale and Attracting Mega-Rounds

The most striking trend is the maturation of the Greek startup sector, evidenced by a shift towards larger funding rounds.

- Record Investment: In 2025, over €732.2 million was invested across more than 90 startups—a 35% increase compared to the previous year.

- Funding Split: While early-stage rounds (pre-seed and seed) remain numerous (75% of all rounds), they accounted for only €117.5 million. The remaining €614.1 million was captured by Series A and later rounds, confirming the ecosystem’s ability to nurture and fund scale-ups.

- The Landmark Deal: This maturity was powerfully validated by the largest funding round of the year: Spotawheel’s €300 million Series C and venture debt financing . The deal, which involved Pollen Street Capital, will fuel the mobility platform’s expansion across Europe, underscoring Greece’s capacity to produce globally competitive companies.

- Greece has already produced significant success stories: Viva Wallet and PeopleCert surpassed US$1 billion in valuation in 2022, becoming unicorns and demonstrating the potential of Greek entrepreneurship.

Top Funded Sectors of 2025

Greek startups are increasingly focused on global megatrends:

- Leading Categories: Artificial Intelligence (AI), Software as a Service (SaaS), and HealthTech attracted the majority of funds.

- Emerging Focus: Defense is officially recognized as a fast-growing, standalone category, reflecting new strategic investment interests.

| Rank | Company | Sector | Funding (Millions €) |

| 1 | Spotawheel | Mobility | 300.00 |

| 2 | Numan | HealthTech | 52.00 |

| 3 | Huspy Holdings | PropTech | 48.41 |

| 4 | Stiq | FoodTech | 35.00 |

| 5 | Achira | DeepTech | 31.40 |

| 6 | Natech | FinTech | 28.14 |

- Corporate Resilience and the International Footprint

The EIB Investment Survey 2025 confirms the broader Greek business environment is robust, with firms showing remarkable international ambition.

- Global Engagement: An outstanding 81% of Greek firms engage in international trade, a rate significantly above the EU average.

- Investment Optimism: Despite prevailing geopolitical and economic uncertainties, 14% of firms expect to increase investment in 2026, compared to just 4% across the EU.

- Innovation & Digital Adoption: 30% of firms invest in innovation (new products/services), in line with the EU average. While general digital adoption is at 56%, adoption of Generative AI is already reaching 19% among SMEs and 27% among large firms.

- Climate Action: Greek companies are prioritizing sustainability, with 84% having implemented carbon-reduction initiatives.

Persistent Challenges

The path to full maturity is not without obstacles. Firms cite high energy costs (92%), skills shortages (90%), and economic uncertainty (90%) as major investment barriers. Furthermore, talent retention, reducing bureaucracy, and improving coordination across the ecosystem remain crucial priorities.8

- Government Incentives: Catalyzing the Next Phase of Growth

To overcome these structural hurdles and capture global attention, the government has focused on key regulatory and fiscal reforms:

- Expanded Tax Deduction for Angel Investors: The income tax deduction for Angel Investors who back Elevate Greece-registered startups is dramatically strengthened. The maximum eligible investment cap will triple to €900,000 (from €300,000), offering a powerful incentive for high-net-worth individuals to engage in early-stage funding.

- Golden Visa for Startups: To attract foreign capital, a residence permit (Golden Visa) is now available for a €250,000 investment in Greek startups, subject to shareholding and job creation conditions.11

- Administrative Simplification: A comprehensive agenda is underway to reduce administrative burdens by 25%, which includes eliminating 15 time-consuming bureaucratic procedures related to R&D, export licensing, and customs. This focuses on creating a more agile and predictable operating environment.

Greece is not just recovering; it is redefining itself as an innovation powerhouse. The combination of its skilled, multilingual workforce, record-breaking investment activity, and a government committed to reducing red tape positions Greece as a formidable contender to become the dominant tech hub in Southeast Europe in 2026 and beyond.

Source: Kathimerini, EIB, FOUND.ATION, Startupblink