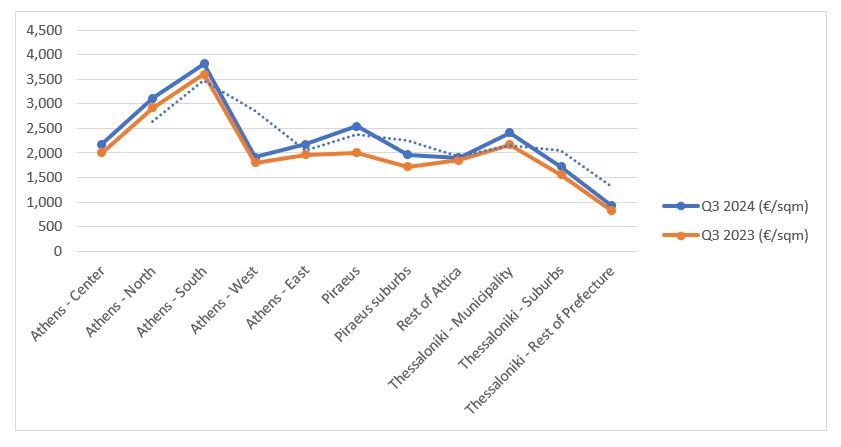

Housing prices and rental rates across Greece continue their upward trajectory, with significant increases in the third quarter of 2024 compared to 2023. Regional apartment price growth varied considerably, with Thessaloniki leading at 12.1%, followed by Athens at 7.7%, other areas at 9.5%, and other major cities at 4.9%.

| Area | Q3 2024 (€/sqm) | Q3 2023 (€/sqm) | Change % |

| Athens – Center | 2,177 | 2,000 | 8.90% |

| Athens – North | 3,111 | 2,915 | 6.70% |

| Athens – South | 3,818 | 3,611 | 5.70% |

| Athens – West | 1,915 | 1,800 | 6.40% |

| Athens – East | 2,174 | 1,951 | 11.40% |

| Piraeus | 2,556 | 2,000 | 27.80% |

| Piraeus suburbs | 1,966 | 1,714 | 14.70% |

| Rest of Attica | 1,899 | 1,846 | 2.80% |

| Thessaloniki – Municipality | 2,400 | 2,164 | 10.90% |

| Thessaloniki – Suburbs | 1,709 | 1,560 | 9.50% |

| Thessaloniki – Rest of Prefecture | 922 | 810 | 13.90% |

Source: Spitogatos

Property Prices by Region

Piraeus, Greece’s largest port, recorded the highest nationwide increase in average sale prices during April-June 2024. In the third quarter, the south suburbs of Athens commanded the highest asking prices at €3,818 per square meter. Piraeus has surpassed central Athens in price, driven by the Golden Visa program, short-term rental demand, and major metro infrastructure projects.

Key Growth Drivers

Greece’s 2024 real estate market benefits from several favourable factors:

- Robust tourism sector

- Strong international investor interest

- Economic recovery

- Political stability

- Competitive pricing versus other European markets

- Attractive returns (3-5% rental yields, ~10% annual appreciation)

- Golden Visa Program

Tourism and Short-Term Rentals

Athens has emerged as a major European tourist destination, ranking 6th in Europe for Airbnb Christmas booking growth with a 31% year-over-year increase, behind only Rovaniemi, Finland.

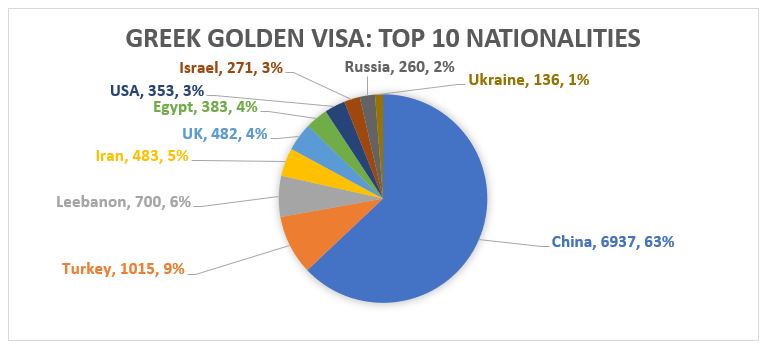

Golden Visa Program Performance

Despite increased minimum investment requirements, Greece’s Golden Visa program saw 12% growth in applications in October 2024 compared to 2023. British investors have shown particular interest, securing 482 permits (3.8% of total) as they seek to regain EU mobility post-Brexit. U.S. nationals obtained 353 permits (2.8% of total) as of August 2024.

Source: Greek of Ministry of Migration and Asylum