As global wealth migration intensifies, Greece is emerging as a top destination for High-Net-Worth Individuals (HNWIs) seeking favorable tax regimes, economic stability, and lifestyle benefits. The country’s competitive non-domicile (non-dom) tax regime, introduced in 2019, has been instrumental in attracting affluent investors and positioning Greece as a leading hub for global wealth relocation.

Greece’s Growing Appeal to Millionaires

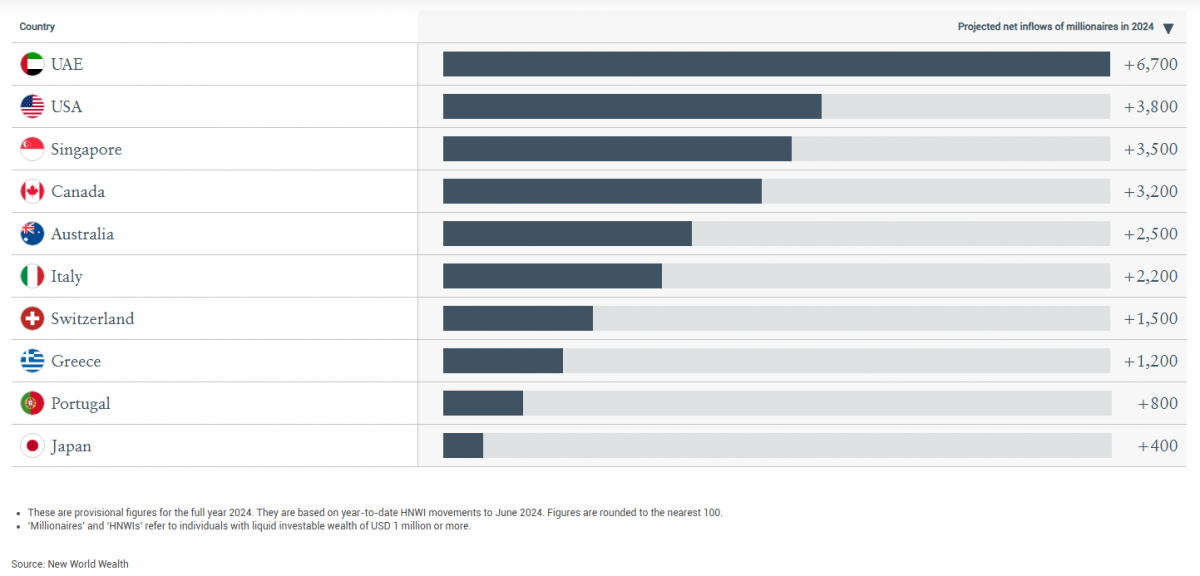

The movement of HNWIs serves as a significant indicator of economic stability, and Greece has been gaining momentum in this regard. According to New World Wealth, from 2022 to 2024, approximately 1,200 millionaires relocated to Greece, making it the eighth most popular destination globally for millionaire migration.

Currently, Greece is home to:

- 64,700 millionaires,

- 105 ultra-high-net-worth individuals (UHNIs), and

- 8 billionaires,

reflecting a 14% increase in its millionaire population over the past decade. The majority of new wealth inflows have been directed toward Greece’s real estate sector, further fueling its investment-driven economic growth.

Additionally, data from Greece’s Finance Ministry reveals that at least 213 investors have successfully transferred their tax residence to Greece under the non-dom tax program. These individuals have relocated from the UK, US, Australia, Argentina, UAE, Russia, and Monaco, reflecting Greece’s growing reputation as a wealth-friendly jurisdiction.

The Greek Non-Dom Tax Regime: Key Advantages

Greece’s non-dom tax regime, modeled after similar programs in Italy, Portugal, Cyprus, Malta, and the UK, offers an attractive alternative for wealthy individuals looking to optimize their tax liabilities. Key highlights include:

- Flat Tax Structure: A fixed annual tax of €100,000 on foreign-sourced income, irrespective of the amount earned abroad, with no requirement to declare foreign income in Greece.

- Investment Requirement: A minimum investment of €500,000 in Greece (real estate, businesses, securities, or corporate shares), to be completed within three years of application.

- Residency Requirement: Applicants must not have been Greek tax residents for seven of the last eight years before transferring tax residency.

- Family Inclusion: Additional family members can be included under the program for an extra €20,000 per year per person.

- Residency Flexibility: Non-dom tax residents are not required to stay in Greece for more than 183 days per year, nor make Greece their primary residence.

A Changing Tax Landscape: Non-Dom Regimes in Other Countries

While Greece has positioned itself as a prime destination for tax-efficient wealth relocation, other European countries are restructuring or tightening their non-dom policies:

- Italy: Initially introduced in 2017, Italy’s non-dom tax regime was designed to attract UHNIs. However, recent legislative changes have doubled the flat tax on foreign income to €200,000 ($218,220) per year, making it less competitive than Greece.

- United Kingdom: The UK has long offered a remittance-based system, allowing non-doms to exclude foreign income from UK taxation unless brought into the country. However, from April 6, 2025, this system will be replaced with a residence-based tax structure, impacting long-term tax planning for international investors.

Why Greece Stands Out as a Top Destination for HNWIs

With favorable tax policies, lucrative investment opportunities, an appealing Mediterranean lifestyle, and economic stability, Greece continues to gain traction as a wealth-friendly jurisdiction. As global tax regimes evolve and some countries tighten their rules, Greece’s non-dom program remains a compelling option for HNWIs and investors seeking tax efficiency, asset diversification, and a high quality of life.