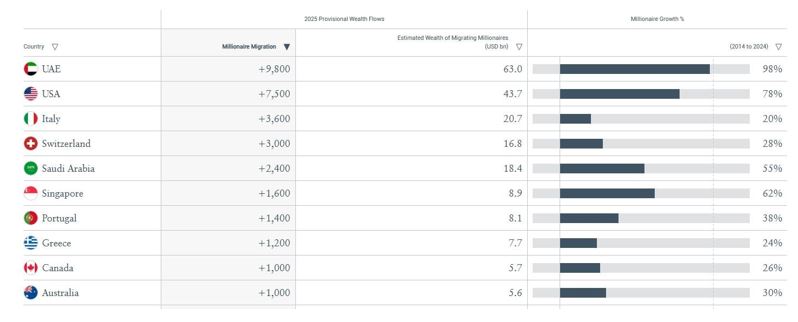

In a world increasingly shaped by geopolitical uncertainty, high taxation in traditional financial hubs, and growing demand for lifestyle mobility, Greece is fast emerging as one of the most attractive destinations for global high-net-worth individuals (HNWIs). According to Henley & Partners, a leading global advisory firm in residence and citizenship by investment, Greece is projected to welcome approximately 1,200 millionaire migrants in 2025 alone, collectively bringing an estimated €7.7 billion in private wealth.

This marks a continuation of a decade-long upward trajectory during which Greece has seen a 24% increase in its millionaire population—a trend in sharp contrast to that of countries like the United Kingdom, which is expected to witness a net outflow of around 16,500 millionaires in 2025.

A Global Shift in Wealth Migration

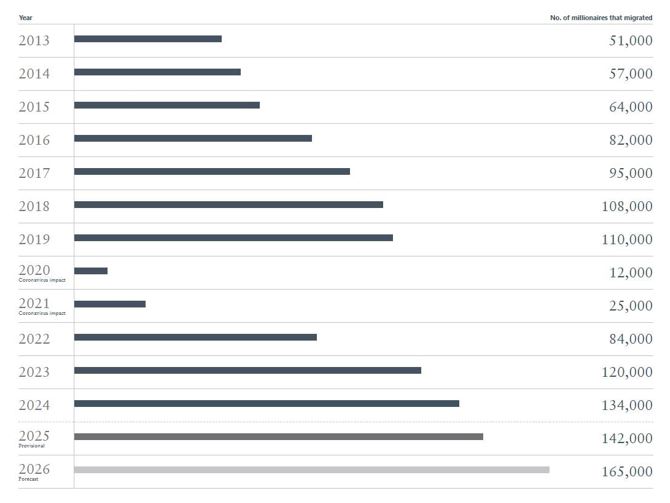

The anticipated movement of 142,000 millionaires across borders in 2025 reflects a significant shift in global wealth migration. Investors are increasingly prioritizing jurisdictions that offer not just economic resilience and political stability but also lifestyle advantages, tax efficiency, and long-term residency pathways.

Greece, along with Italy, Portugal, the United Arab Emirates, and Australia, is part of an elite cohort of nations reaping the benefits of this shift. Among these, Greece has distinguished itself through the strategic combination of its Golden Visa program and its non-domiciled tax regime, both designed to attract capital, entrepreneurial talent, and affluent individuals.

Strategic Taxation Incentives: A Policy Engine for Growth

Greece’s investment migration architecture is anchored in two key offerings:

- The Golden Visa Program: Offering a five-year renewable residence permit to non-EU nationals who invest a minimum of €250,000 in real estate (recently revised to €400,000 and €800,000 in certain areas).

- The Non-Domiciled Tax Regime: Enabling qualifying foreign nationals who relocate their tax residency to Greece to pay a flat annual tax of €100,000 on all foreign-sourced income, regardless of the amount earned globally.

These incentives are proving exceptionally effective in attracting international investors looking to optimize their tax planning while enjoying the benefits of European residency and Greece’s unparalleled quality of life.

Upcoming Legislative Reforms: Removing Barriers, Increasing Flexibility

Recognizing the need to remain globally competitive, Greece is preparing to introduce landmark reforms to its non-dom tax framework. The Ministry of National Economy and Finance is expected to submit a new bill to Parliament, introducing key modifications aimed at resolving long-standing structural limitations.

Current Framework Highlights:

- Applicants must not have been Greek tax residents for 7 out of the last 8 years.

- A minimum investment of €500,000 is required in real estate or Greek entities.

- A flat tax of €100,000 per annum is applied to foreign-sourced income.

Proposed Enhancements:

- Inclusion of Post-Marriage Spouses: Under the current regime, spouses who marry after one partner enters the scheme cannot benefit. The reform proposes removing this restriction to allow full spousal inclusion.

- Abolition of Gift and Inheritance Taxes on Foreign Assets: Presently, participants are taxed on gifts and inheritances received abroad. The new legislation would eliminate these levies, aligning Greece’s offering with investor-friendly norms seen in other jurisdictions.

These forward-looking changes are designed to increase participation, reduce administrative complexity, and place Greece on par with—or ahead of—competing destinations such as Italy and Portugal.

Economic Impact and Future Outlook

Since the launch of the non-dom regime in 2020, Greece has attracted over 213 HNWIs under this scheme. These individuals have invested more than €277 million—over twice the statutory minimum—and have each contributed €100,000 annually in taxes, reflecting both their commitment and the program’s financial viability.

When combined with the continued success of the Golden Visa program, which has issued over 48,000 permits since inception, the contribution of these initiatives to Greece’s real estate sector, taxation revenue, and broader economic ecosystem is undeniable.

Moreover, the high-value profile of these investors often translates into additional economic multipliers, such as:

- Secondary investments in tourism, hospitality, and renewable energy sectors;

- Family office and private banking services;

- Philanthropic and cultural patronage, particularly in Greek heritage and education.

Why Greece? The Strategic Advantage

Beyond its favorable tax policies, Greece offers investors a compelling value proposition:

- Strategic Location: Serving as a gateway between Europe, Asia, and Africa;

- Political and Economic Stability: A member of the Eurozone and Schengen Area, with improving fiscal health and strong GDP forecasts;

- High Quality of Life: Access to top-tier healthcare, education, and a Mediterranean lifestyle;

- Affordable Real Estate Market: Especially compared to peers such as France, Spain, and the UK.

Conclusion: A New Epicenter for Global Wealth

As international investors reevaluate traditional wealth havens in favor of jurisdictions that offer long-term sustainability, legal transparency, and personal wellbeing, Greece is rapidly cementing its status as a premier destination for global wealth migration. With forthcoming reforms poised to enhance its competitiveness, Greece is not merely following global trends—it is shaping them.

For family offices, institutional investors, and HNWIs exploring relocation or tax efficiency strategies, Greece represents not just a lifestyle choice, but a strategic investment in a stable and prosperous future.

Source: Henley & Partners, MoneyReview